cryptocurrency tax calculator us

Subscription plans start with 99year for Starter to 1899year for the Accountant plan. Free Crypto Tax Calculator for 2021 2022.

Best Crypto Tax Software Top Solutions For 2022

Enter your taxable income minus any profit from crypto sales.

. Our customers choose us over other. This guide details the tax obligations for crypto investors and answers many commonly asked questions on a wide range of scenarios that may apply to your crypto. According to a May 2021 poll 51.

US Tax Guide 2022. If you held it for a year or less youll pay the short-term rate. Your cryptocurrency tax rate on federal taxes will be the same as your capital gains tax rate.

Crypto Tax Calculator Use our calculator to get an estimate of the taxes on your cryptocurrencybitcoin sales. You simply import all your transaction history and export your report. Enter your taxable income.

Select the appropriate tax year. Select the tax year you would like to calculate your estimated taxes. You can estimate what your tax.

Enter Your Personal Details. Valid from 1126 to. This means you can get your books.

Yes CryptoTaxCalculator is designed to generate accountant friendly tax reports. If you owned it for more then a year youll pay the long-term rate which is lower. Check out our free Cryptocurrency Tax Interactive Calculator that in just one screen will answer your burning questions about your cryptocurrencyBitcoin sales and give.

Lets calculate the tax in the above example. The popularity of cryptocurrencyBitcoin investments continues to skyrocket. In this article we go over the main features of a cryptocurrency tax calculator.

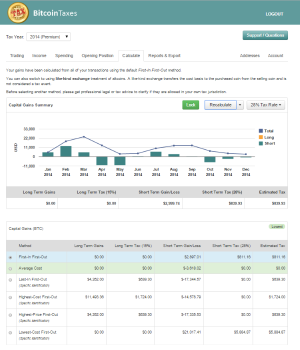

2021 Filing Status Estimated 2021 Taxable Income Cost of. A cryptocurrency tax calculator is a software that helps you to calculate the value of tax which is liable to pay for the gains under the crypto transactions. LIFO Last-In-First-Out According to the LIFO accounting method the.

As a refresher short-term capital gains had a rate of 10 to 37 in 2021 while. They allow users to cancel a subscription at any time with a 30-day money-back. Forbes recently posted this handy guide with a chart of the 2020-2021 tax brackets for your reference.

Choose your tax filing status. The new software as a service SaaS application simplifies the process of US tax filings for those who hold cryptocurrency assets and need to report so on their US tax returns. If your annual income is less than 9875 youll be subject to a 10 tax rate on your.

Use code BFCM25 for 25 off on your purchase. A cryptocurrency tax calculator is a software that helps you to calculate the value of tax which is liable to pay for the gains under the crypto transactions. Select your tax filing status.

Cost price April 3000.

How To Calculate Crypto Taxes Koinly

Ultimate Crypto Tax Guide 2022 Koinly

How Does Crypto Tax Work Expat Tax Online

10 Best Crypto Tax Software In 2022 Top Selective Only

How Is Cryptocurrency Taxed Forbes Advisor

Cryptocurrency Tax How Is Cryptocurrency Taxed Zenledger

Capital Gains Tax Calculator Ey Us

.jpg)

Crypto Tax Rates Complete Breakdown By Income Level 2022 Coinledger

Coinpanda Free Bitcoin Crypto Tax Software

10 Best Crypto Tax Software In 2022 Top Selective Only

A Beginner S Guide To Filing Cryptocurrency Taxes In The Us Uk And Germany

Tax Forms Explained A Guide To U S Tax Forms And Crypto Reports Coinbase

A Beginner S Guide To Filing Cryptocurrency Taxes In The Us Uk And Germany

![]()

Cointracking Crypto Tax Calculator

Cryptocurrency Taxes A Guide To Tax Rules For Bitcoin Ethereum And More Bankrate